Frequently Asked Questions

Property Tax

-

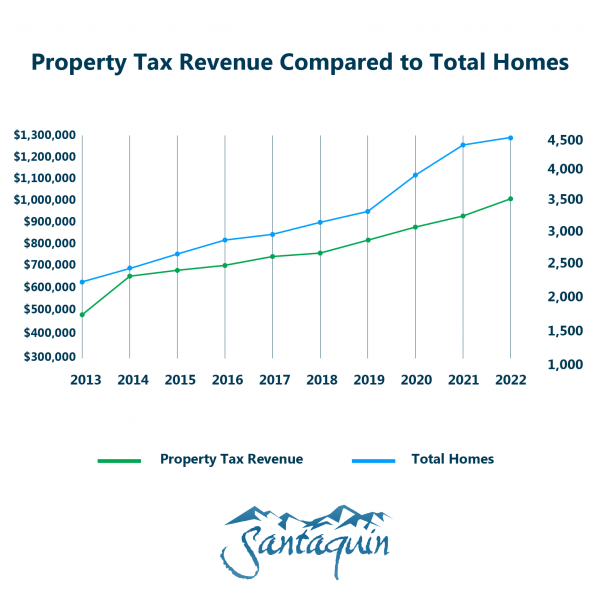

The Santaquin City portion of the property tax rate has not been raised since 2013. During that same time period, the number of homes in Santaquin City has grown by an unprecedented 107% while the property tax rate has decreased by 57%.

Per Utah State Law, the City must decrease the property tax rate when property values increase so that the overall amount of money the City receives stays the same. Unless the City adjusts the property tax rate, the overall revenues it receives will stay the same while costs continue to rise due to inflation.

-

The increase will generate approximately $595,000 in revenue each year.

-

The cost to the average household will be approximately $10 per month.

-

The property tax rate is calculated by the State of Utah using information and data from Utah County and Santaquin City. The City has identified a need for $595,000 in additional annual revenues. The new rate is 0.001404.

-

The City would dedicate approximately $595,000 in revenues generated from this proposed property increase to fund two police vehicles and maintain the recent fair-market compensation increases for firefighters and police officers.

-

The City receives more property tax revenues when more homes are built. However, property tax revenues do not increase at the same rate as growth. This is due to how the property tax rate is calculated. Utah State Law requires that the City’s property tax rate decrease when home values go up so that the amount of money the City receives from existing homes stays the same.

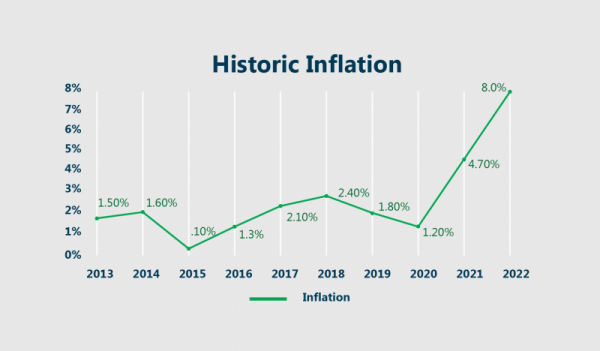

While the number of homes has more than doubled, property tax revenues from those homes have only increased by 66%. In addition, inflation has increased by 24.7% during that same time period, reducing the City’s ability to pay for needed wages, goods, and services. Unless the City adjusts the property tax rate, the revenues it receives from existing homes will stay the same while costs continue to rise due to our population growth and historic inflation.

-

When property valuations increase or decrease, property tax rates change to maintain revenue neutrality. This revenue-neutral rate is called the certified tax rate. The certified tax rate is then applied to all properties, including new residential and commercial developments. The Santaquin City certified tax rate itself has decreased by 57% in the last ten years.

-

Property tax revenues have only increased over the past ten years due to growth. Newly built homes and businesses pay property taxes that have increased the overall amount of revenues the City has received. While these revenues have increased, so has the need for the City to provide vital services to more residents.

-

The City has a demonstrated history of efficiently and effectively using trusted taxpayer resources for the public good. The City has kept its commitment to use the revenues from the last property tax increase in 2013 to maintain critical infrastructure, improving 71.2% of all city-owned roads. Visit this interactive map to see exactly which roads have been maintained with the revenues.

-

The value of your home or business property is determined by the Utah County Assessor, not Santaquin City. Property values change regularly. The market itself drives property values and throughout the year, as homes sell, some areas go up in value, some go down, and others do not change at all. The Utah County Assessor uses market-based information to value each property. Some property values may change dramatically in a single year, while other property values may change little in a given year.

-

The new rate will go into effect for the 2023 tax year.

-

Homeowners only pay taxes on 55% of the assessed value of their home. So, if the Utah County Assessor determines that the value of a home is worth $434,000 and that home is the primary residence for someone, the owner would pay taxes on that property as if it were worth $238,700 (55% of the full value). Commercial properties and second homes are assessed taxes on 100% of their value.

-

No. The city portion of property tax is a relatively small amount of your overall bill. Under Utah State law, local government entities may apply and collect a property tax. Local entities such as school districts, counties, cities, and special service districts are all responsible for levying their own taxes. The average property tax bill a Utah taxpayer receives includes payments for all these entities, not just the city or town where they reside.

-

Yes. Utah County offers several property tax relief programs for qualifying residents. For more information, click here.

-

Truth in Taxation is the name for a process established by the Utah State Legislature where city and county governments and school districts are required to hold a public hearing and inform taxpayers of potential increases prior to the city council voting on them.

Utah State Law requires that property tax rates automatically adjust when property values increase or decrease so that the amount of money the city receives is the same from year to year. The laws are designed to keep property owner’s tax burden at a constant level from year to year unless the city council votes to increase the tax through a public process.

-

There are several resources available to you if you have questions about your property tax. You can call us at (801) 754-3211, email us at office@santaquin.gov, or stop by our offices at 110 S. Center Street.